10 Simple Techniques For Bankruptcy Discharge Paperwork

Table of ContentsIndicators on How To Get Copy Of Chapter 13 Discharge Papers You Need To KnowExamine This Report on Obtaining Copy Of Bankruptcy Discharge PapersThe 8-Second Trick For Chapter 13 Discharge PapersExcitement About Copy Of Bankruptcy Discharge

For objectives of this magazine, references to U.S. trustees are also appropriate to personal bankruptcy managers. A fee is billed for converting, on request of the borrower, an instance under phase 7 to a situation under phase 11.

There is no charge for transforming from phase 7 to chapter 13. Unsafe financial obligations normally may be defined as those for which the expansion of debt was based simply upon an assessment by the financial institution of the debtor's capacity to pay, as opposed to guaranteed debts, for which the extension of credit history was based upon the financial institution's right to take collateral on default, in enhancement to the borrower's capacity to pay.

The offers for economic items you see on our system originated from firms who pay us. The cash we make assists us give you access to free credit history and also records and aids us develop our other fantastic devices and academic products. Settlement might factor right into exactly how as well as where items show up on our system (and in what order).

Some Ideas on Copy Of Chapter 7 Discharge Papers You Need To Know

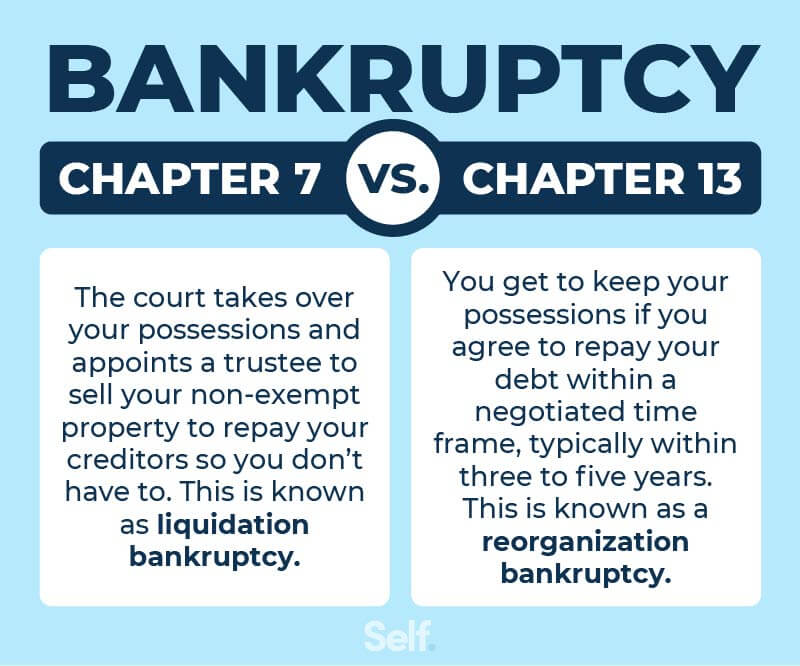

That's why we give attributes like your Approval Chances and also financial savings estimates. Certainly, the offers on our platform don't represent all financial items around, however our goal is to show you as numerous wonderful options as we can. The primary step in determining whether a personal bankruptcy is right for you is specifying what it is.

Discharge is the lawful term significance you're not legitimately needed to pay the financial debt, as well as collection agencies can not take any more activity to collect it. Adhering to a bankruptcy discharge, financial obligation collectors and also loan providers can no much longer try to gather the discharged financial obligations. That means no a lot more calls from collection agencies and say goodbye to letters in the mail, as you are no more directly responsible for the financial obligation.

With a secured financial debt, the lending is connected to a property, or security, that lending institutions can take if you quit paying. https://wadline.com/b4nkruptcydc. Unsafe debt is not backed by security, so lenders don't have the exact same choice (how to get copy of bankruptcy discharge papers). If you really feel the crushing weight of bank card financial debt and also an auto loan on your shoulders, a bankruptcy could be a practical service thinking you recognize the effects.

When you clean your financial slate with a bankruptcy, you'll need to handle some credit-related repercussions. A personal bankruptcy will certainly stay on your credit history records for as much as either 7 or 10 years from the day you submit, relying on the kind of bankruptcy. Given that your credit report ratings are determined based on the info in your credit rating records, a personal bankruptcy will certainly affect your credit rating also.

How To Get Copy Of Bankruptcy Discharge Papers for Dummies

For additional information, look into our post on what takes place to your credit rating when you apply for insolvency. A discharged Chapter 7 insolvency and a released Phase 13 insolvency have the exact same influence on your credit report, though it's feasible a loan provider might look extra favorably on one or the other.

Removing debt collectors is a fantastic advantage, but you might spend the bulk of one decade fixing your debt. An insolvency discharge might be the proper way for you to leave debt. Take into consideration various other paths to financial debt liberty and also economic stability, such as a financial debt settlement or a financial debt layaway plan, prior to choosing personal bankruptcy as the best means ahead.

He has an MBA in finance from the University of Denver. When he's away from the keyboard, Eric delights in discovering the world, flying tiny Find out more (https://0rz.tw/7kgj9)..

Find out more regarding financial debts released at the end of Phase 13 personal bankruptcy. Noand several locate this fact unusual. Instead of detailing the wiped-out financial debts, the order will certainly provide general info regarding financial debt groups that don't go away in bankruptcy or "nondischargeable financial obligation." As an example, it will discuss that you'll likely remain in charge of paying: residential assistance commitments (spousal or kid assistance) most pupil financings and also tax debt accounts that the court determines you can't discharge most fines, penalties, and also criminal restitution some financial obligations that you failed to detail appropriately specific lendings owed to a retired life plan cash owed as an outcome of hurting someone while operating a vehicle while intoxicated, and also responsibilities covered by a reaffirmation contract (a court-approved arrangement to proceed paying a lender).

4 Simple Techniques For Copy Of Bankruptcy Discharge

Obligations occurring from fraudulence devoted by the borrower or injury triggered by the debtor while intoxicated are financial obligations that the court may declare nondischargeable. Although a discharge eases you of your obligation to pay a financial obligation, it won't get rid of a lien that a creditor might have on your building (https://anotepad.com/note/read/nmy6f95w).

Some liens can be removed, nonetheless, also after the closure of the insolvency case. After the court issues the discharge, financial institutions holding nondischargeable financial obligations can view it now proceed collection initiatives.

The info permits the financial institution to validate the insolvency as well as that the discharged financial obligation is no more collectible. You'll locate the declaring day and instance number at the top of practically any kind of paper you obtain from the court. The discharge day will show up on the left-hand side of the discharge order quickly alongside the releasing judge's name (you'll locate the situation number in the top box).